Free Budget Planner: Take Control of Your Money

Build Your Custom Budget in Minutes

Our free budget planner makes it simple to manage your finances especially if you’re struggling.

- Input your income, expenses, and savings goals, and watch your custom plan come to life – ready to download in minutes.

- No complicated apps, no endless forms, just a straightforward tool built for you.

- Whether you’re juggling rent, groceries, or loan payments, this budget planner helps you take control, cut the stress, and keep your money on track.

At Loan Lenders, we’re all about smart financial moves – start with this free tool today and see the difference!

Online Budget Planner

Simple Budget Planner

Plan your finances, unlock a wealthier you—tailored for South Africans!

0% of goal reached

Your Budget Summary:

Total Income: R0.00

Total Expenses: R0.00

Savings Left: R0.00

How to Use Your Budget Planner CSV File in Google Sheets – A Simple Guide

Once you’ve hit “Download for Google Sheets you’ll get a csv file.

Here’s a simple explanation of how to use your budget planner CSV file.

It’s easy!

- After downloading the “budget_planner.csv” file from our Simple Budget Planner, open Google Sheets by visiting sheets.google.com or using the Google Sheets app.

- Click “File” in the top menu, then select “Import” to upload your CSV file.

- Then select the “Upload” tab and you’ll be able to drag the csv file directly into Google Sheets.

- Alternatively, you can drag the file from your computer directly into your Google Drive, and Google Sheets will prompt you to open it as a new spreadsheet.

- Choose “Replace spreadsheet” or “Create new spreadsheet” to load the data, which will appear in two columns: “Item” and “Amount (R)” for your Rands.

- You’ll see all your income (like Salary, Grant, and Side Hustle), expenses (like Rent, Groceries, and any Extra Expenses), and a Budget Summary with Total Income, Total Expenses, and Savings Left.

- To make it look polished, use Google Sheets’ formatting tools—bold the headers, set column B to Rand currency (R), add borders, or create a chart to visualize your budget.

- Save the file in your Google Drive to access it anytime, and share it with family or friends if needed.

It’s free, fast, and perfect for managing your Rands from anywhere.

This simple process works great for South African users looking to track their finances easily!

How to Use Your Budget Planner on Your Mobile Smartphone in South Africa

- Download the File: Tap the “Download for Google Sheets (.csv)” button on our budget planner. Your phone will save the file to your “Downloads” folder or “Files” app (on Android) or “Files” or “iCloud Drive” (on iOS). It’s quick and uses minimal data!

- Open Google Sheets: If you don’t have the Google Sheets app, get it free from the Google Play Store or App Store. Open the app on your phone and log in with your Google account (most South Africans already have one).

- Import the CSV: In Google Sheets, tap the “+” icon to start a new spreadsheet, then choose “Import.” Find the “budget_planner.csv” file in your Downloads or Files app, tap it, and select “Replace spreadsheet” or “Create new spreadsheet” to load your data. You’ll see your income (like Salary or Grant), expenses (like Rent or Groceries), and a Budget Summary with Total Income, Total Expenses, and Savings Left in Rands.

- Format Your Budget: Tap the columns to format—bold the headers, set amounts to Rand (R) currency, add borders, or create a chart for a polished look. Save it in your Google Drive to access anytime, even offline!

Why Our Budget Planner Is Your Financial Game-Changer

Taking control of your finances begins with understanding where your money goes each month.

- This free budget planner gives you the tools to track your expenses, plan for the future, and make informed decisions about your loans and spending habits.

- By using this budget planner regularly, you’ll be better positioned to manage your debt, build savings, and achieve your financial goals in South Africa’s unique economic landscape.

- Whether you’re saving for a home, planning for education costs, or working toward debt freedom, a clear budget is your first step.

- Don’t wait to take charge of your financial health.

- Start with our free budget planner today, download it, set realistic goals, and watch as your financial confidence grows with each rand you track and save.

PS. If you’re at all confused, take a look at these 7 Essential Steps for Effective Budgeting and Planning to Build Long-Term Wealth

Truth About Debt Review: Is It Worth It in SA?

What Debt Review Really Means for You in South Africa

Here’s what you’ll find out:

- Unexpected costs that could catch you off guard

- How it traps or frees your finances

- Real answers for your debt dilemma

- Alternatives to debt review

Furthermore, for anyone in a tight financial spot and thinking of debt review as a lifeline, this post I came across on Reddit may interest you.

Reddit Post Titled "Ways to Manage Debt"

I don’t really have contact with my parents or anyone to talk to about this.

So I have about 30k in debt 23k with my credit card and 7k with my overdraft.

I receive disability from a private fund of about 2k a month and make about 1k doing odd jobs a month.

The issue is my debt is just too much for me to handle while paying for food like by R500 to much the repayments come to R1500 and I can only afford R1000.

And I’ve gone back to studying to manage my future.

I managed to secure funding for my medications and studies with someone.

So I’m trying my best to manage the disability.

I’ve heard about debt review but I’m not sure if it’s worth it for my case?

Do I reach out to the credit provider to make a plan?

Do I have to find a debt review agency and will it cost me to have a consultation?

I’m not completely helpless and can make some money on my own but it’s not very consistent and not a lot.

(Ref – Reddit article: https://www.reddit.com/r/PersonalFinanceZA/comments/1ijs2y1/comment/mfrgazb/)

Pros and Cons: Is Debt Review Worth It?

Sounds like you’re in a tough spot especially with no one to chat this over with.

So this sums up your debt situation with some solutions;

- Your current financial situation:

You’ve got R23k on your credit card and R7k overdraft: R30k total.You’re pulling in R2k from disability and maybe R1k from odd jobs, so R3k max.

Repayments are R1.5k, food’s R500, and you’re R500 short every month.

So your debt’s mounting month on month if I’ve got that right?

- Debt Review:

This is basically how debt review works.You get a debt counsellor, through a legit debt company – make sure that they’re registered with the NCR (National Credit Regulator) – see a list of debt counsellors currently registered on the NCR website.

Then the debt counsellor, acting on your behalf, steps in and talks to your creditors, who will hopefully reduce your payments to something like R1k per month.

So then you only pay one amount per month leaving them to split it up and allocate payments accordingly.

It stops calls, legal stuff and the general debt pressure you’re probably under.

However, you’re locked in, no new loans or credit cards till it’s all paid – it’s no picnic and will be pretty hard going at times.

- Getting further finance while on Debt Review:

Nope, the National Credit Act prohibits financial institutions from providing loans for debt review clients any type of funding to anyone undergoing the debt review process. - Watch Out – Unexpected Costs & Downside of Debt Review:

It’s not free, and on average it’s R50 to start, then up to R8k taken from your first payments, plus 5% monthly (max R450).Big catch: it’s on your credit record till you’re done, which could be years with R30k.

If your odd jobs pick up, you’re still stuck in the plan.

- Benefits of Managing the Debt Yourself: If you call your bank or credit card company and beg for a lower payment (like R1k), you keep control.

No fees, no bad credit mark if you stay on track, and you’re free to adjust if money gets better.

Plus, paying extra when you can reduces the debt much faster.

- Debt Review Good Side:

It’s a lifeline if you’re drowning – steady payments, no stress from creditors.Works with your fixed R2k disability cash.

But it’s a long haul, not a fix and many people have regretted it as they’re not able to cut back on lifestyle expenses.

- Think Twice Before Going Under Debt Review:

Debt review’s a big step – an option if you’re totally sunk, but it costs you cash and freedom.Managing it yourself could save you hassle and money if you’re disciplined & committed to making it work for you.

- What to do next:

Try calling your bank first and ask for a break on payments.If they won’t budge and you’re desperate, talk to an NCR-registered debt counselor.

Disclaimer: I’m no money pro; get proper advice.

Don’t share personal details online.

For more info, read this summary on What is Debt Review.

4 Real Alternatives to Debt Review

Going under debt review isn’t for the faint hearted and it’s worth looking at these alternatives which may be more manageable and still get you out of debt.

- Negotiate Directly:

Skip the middleman—call your creditors yourself.In South Africa, banks might lower payments if you explain your situation, like living on R2k disability cash.

No fees, no credit lock, just guts.

Debt Consolidation:

Bundle that R23k credit card and R7k overdraft into one loan with a lower rate.

SA lenders like Capitec offer this—it’s simpler than debt review and keeps your credit alive if you pay on time.

Side Hustle Boost:

Odd jobs at R1k/month?

Push it up with freelancing or selling stuff online.

More cash means tackling debt without signing your life away to a review process.

Budget Like a Boss:

Slash extras (R500 food bill?) and throw every spare rand at debt.

It’s old-school, but it works—DIY freedom beats years under debt review’s thumb.

Read these 7 Steps for effective Budgeting and Planning to build long-term wealth

These options sidestep the costs and credit traps of debt review and definitely worth a shot instead of going under review.

Taking Control: The Truth About Debt Review and You

Debt doesn’t have to define you in South Africa.

Whether you choose debt review to steady the ship or fight it out with smarter budgeting and creditor talks, you’ve got real options.

You’re not helpless—R30k in debt on R3k income is tough, but South Africans like you have options.

Debt review can stabilize payments, costing fees and credit limits, or you can negotiate, consolidate, or hustle your way out.

The truth about debt review is it’s a tool, not a cure.

Pick what fits, act now, and own your future—one step at a time.

SASSA Black Card Application: Everything You Need to Know

What Is the SASSA Black Card and How Do You Apply For the New Postbank Black Card?

As a grant beneficiary you will need to submit your SASSA black card application as it will be the SASSA Gold Card replacement.

This is because it is being phased out, and the new Postbank Black Card is taking its place.

Therefore, as a SASSA grant recipient, you’ll need to apply for the new card to continue receiving your social grant payments.

This guide simplifies the SASSA Black Card application process, walking you through each step.

We’ll cover everything from eligibility requirements and required documents to where you can apply and what to expect after your application is submitted.

Don’t get caught off guard – learn how to secure your new Postbank SASSA card today!

Where To Get SASSA Black Card

Everyone wants to know where to get the SASSA black card as time is running out to change from the gold card to ensure you still get your monthly payments.

So if you’re also wondering where can I get my SASSA black card, follow these steps:

- Go to a SASSA Office:

Go to your nearest South African Social Security Agency (SASSA) office for assistance. - Check Eligibility:

Ensure you qualify for a SASSA grant, as the card is issued to approved beneficiaries. - Contact Postbank:

The SASSA Gold Card is issued in partnership with Postbank.

Visit a Postbank branch or call their customer service for details. - Required Documents:

Bring your ID, proof of address, and any other documents requested by SASSA. - Activation:

Once issued, activate the card at an ATM or Postbank branch to start using it.

Read on for all the information regarding the documents you’ll need and how you can contact SASSA.

You should do this immediately as long queues are already forming at SASSA and Postbank offices as people are worried about not getting their grant payments.

So hurry and get this done today!

Understanding the Postbank Black Card Transition

Why is the SASSA Gold Card Being Replaced?

The South African Social Security Agency (SASSA) is transitioning from the Gold Card to the Postbank Black Card for several key reasons:

- Enhanced Security:

The Postbank Black Card offers improved security features to protect beneficiaries from fraud and unauthorized access to their funds. - Modernization:

This change aligns with SASSA’s ongoing efforts to modernize its payment systems and improve efficiency. - Improved Functionality:

The Postbank Black Card may offer additional features and functionalities in the future, enhancing access to social grants. - Addressing Challenges:

The transition aims to address challenges some beneficiaries have faced with the Gold Card, such as technical issues and limited access points.

You may have heard news about SASSA cards not working or seen reports about SASSA cards to be discontinued – this change is designed to resolve those problems.

What are the Benefits of the Postbank Black Card?

The Postbank Black Card offers several advantages for SASSA beneficiaries:

- Secure Transactions:

Enhanced security features help protect your grant money. - Wider Access:

You can use the Postbank Black Card at a wider network of ATMs and POS terminals across South Africa. - Convenience:

The card offers convenient access to your SASSA grant payments. - Potential Future Features:

Postbank may introduce additional features and benefits for cardholders in the future. Keep an eye out for official SASSA gold card news regarding any new card features.

Who is Eligible for the Postbank Black Card?

All current SASSA grant beneficiaries who are receiving payments through the Gold Card will be eligible to receive a Postbank Black Card.

This includes beneficiaries of various grant types (Older Persons Grant, Disability Grant, Child Support Grant, etc.).

If you are currently receiving a SASSA grant, you will need to complete the SASSA black card application process.

Deadlines To Transition From Gold Card and To Submit SASSA Black Card Application

- More than two million social grant beneficiaries still need to change over to the new Postbank Black Card

- The previous deadline for the transition was 28 February 2025

- The new deadline has been extended to 20 March 2025.

- Postbank has partnered with the Spar Group to speed up the process of switching over by adding 200 service sites and trained tellers.

- Postbank aims to complete the transition by 30 June.

5 Step Guide to the SASSA Black Card Application

Documents Needed for the SASSA Black Card Application

- Valid South African ID or passport.

- Proof of residence (e.g., utility bill or bank statement).

- SASSA grant approval letter (if applicable).

- Your existing Gold Card (if you have it).

- Any other documents specifically requested by SASSA or Postbank.

What to Do if You’re Missing Documents?

If you don’t have all the required documents, contact SASSA or Postbank for guidance.

They may offer alternative solutions to help you complete your application.

How and Where To Submit Your SASSA Black Card Application

You can apply for your Postbank Black Card at the following locations:

- Designated Postbank branches nationwide.

- Designated SASSA offices.

- (If available) The official Postbank online portal. Check the Postbank website for the most up-to-date information on application channels.

The Application Process: A Breakdown

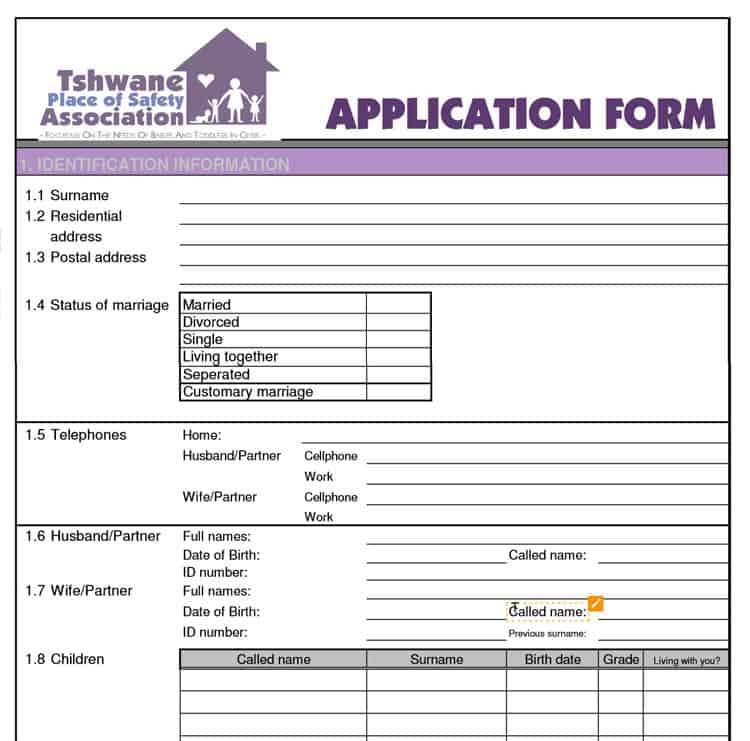

The SASSA black card application process typically involves these steps:

- Visit your chosen application location (Postbank branch or SASSA office).

- Present your required documents to the official assisting you.

- Complete the application form accurately.

- (If required) Undergo biometric registration (fingerprints, photo).

- Receive confirmation of your application.

What to Expect After Applying

After submitting your SASSA black card application, you can expect:

- A processing period (the duration may vary, so enquire at your application point).

- Notification regarding the status of your application (SMS or other communication).

- Collection of your Postbank Black Card once it’s ready. You will be informed where and when to collect it.

Wait For Confirmation and Postbank Card Delivery

Can You Apply for the SASSA Black Card Online?

Currently, the SASSA Black Card application must be done in person at a SASSA office or Postbank branch. Keep an eye on official announcements for any updates about online applications.

How Long Does the SASSA Black Card Application Take?

Processing Time for the SASSA Black Card

The application process typically takes 7–10 working days.

However, this may vary depending on your location and the volume of applications.

How to Check Your SASSA Black Card Application Status

Activating and Using Your SASSA Black Card

How to Activate Your SASSA Black Card

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Accessing Your SASSA Grant Payments

Once you have your Postbank Black Card, you can access your SASSA grant payments through:

- ATMs nationwide (check for Postbank-partner ATMs for potentially lower fees).

- Participating retailers and POS terminals.

Where Can You Use the SASSA Black Card?

- All major retailers.

- Postbank and partner ATMs.

- Online and in-store payment platforms.

Understanding Transaction Fees and Limits

- Postbank will provide information on any transaction fees associated with using the card.

- There may be daily or monthly limits on withdrawals and transactions. Check with Postbank for the specific limits that apply to the Postbank Black Card.

Security Tips for Your Postbank Black Card Safely

- Keep your PIN confidential. Never share it with anyone.

- Protect your card from loss or theft.

- Report lost or stolen cards immediately to Postbank.

- Be aware of potential scams and never share your personal information with unverified sources.

How the SASSA Black Card Will Affect SRD R350 Grant Recipients

Current Payment Methods for SRD R350 Grants

SRD R350 grant recipients typically receive payments through:

Bank accounts (if they provided their banking details).

Cash Send (via mobile money transfers).

SASSA Gold Card (for those without bank accounts).

If you’ve been using the SASSA Gold Card to access your SRD R350 grant, you’ll need to transition to the new SASSA Black Card.

Do SRD R350 Recipients Need to Apply for the SASSA Black Card?

If you’re already using the SASSA Gold Card for your SRD R350 payments, SASSA will likely notify you about the transition process. You may not need to reapply, but you should confirm this with SASSA or Postbank.

If you’re new to the SRD R350 grant or haven’t provided banking details, you may need to apply for the SASSA Black Card to receive your payments.

What Happens if You Don’t Switch to the SASSA Black Card?

Once the SASSA Gold Card is discontinued, it will no longer work for withdrawals or payments. If you’ve heard about SASSA cards not working, this could be the reason.

To avoid disruptions in receiving your SRD R350 grant, make sure to switch to the new SASSA Black Card as soon as possible.

How to Update Your Payment Method for the SRD R350 Grant

If you prefer not to use the SASSA Black Card, you can update your payment method to a personal bank account or Cash Send. Here’s how:

Visit the SRD grant website: https://srd.sassa.gov.za.

Log in using your ID number and phone number.

Update your payment details under the “Payment Method” section.

Key Takeaways for SRD R350 Grant Recipients

If you’re using the SASSA Gold Card, you’ll need to transition to the SASSA Black Card to continue receiving your SRD R350 grant.

SASSA will notify you about the transition process, but it’s a good idea to proactively check your status or visit a SASSA office for confirmation.

If you prefer, you can switch to a bank account or Cash Send as your payment method instead of using the new card.

Troubleshooting and FAQs

SASSA Gold Card Expiration?

The SASSA Gold Card is being replaced by the Postbank Black Card.

While there may have been expiry dates on older versions of the Gold Card, the transition to the Black Card means that the SASSA Gold Card expiry date could be any day soon.

Therefore, the focus should be on applying for and using the new Postbank Black Card.

It’s best to contact SASSA directly (0800 60 10 11) for any specific questions about the SASSA Gold Card expiration and phase-out and whether there is an official SASSA gold card expiry date as this information can change.

Keep an eye on official SASSA gold card news for the most up-to-date details.

Don’t delay your SASSA black card application!

Can I Still Use My SASSA Gold Card?

How to Activate My Postbank Black Card?

Your Postbank Black Card will likely need to be activated before you can use it. The activation process usually involves one of the following methods:

- USSD Activation: You may be able to activate your card by dialing a specific USSD code on your mobile phone and following the prompts.

- ATM Activation: Some cards can be activated at a Postbank ATM. Insert your card and follow the on-screen instructions.

- Phone Activation: Contact Postbank’s customer service line (0800 53 54 55) and follow their instructions to activate your card.

Postbank will provide specific instructions with your card. Look for a pamphlet or letter that comes with the card. If you’re unsure, contact their customer service line for assistance.

How to Reset PIN

If you’ve forgotten your Postbank Black Card PIN, you’ll need to reset it. The process usually involves one of these options:

- Visiting a Postbank Branch: The most common method is to visit your nearest Postbank branch with your ID document and your card. A consultant will assist you with resetting your PIN.

- Phone Banking (If Available): Some banks offer PIN reset through their phone banking system, but this may require prior registration. Contact Postbank to see if this is an option.

For security reasons, PIN resets are generally not done online. It’s crucial to protect your PIN and never share it with anyone.

What Should I Do If My SASSA Black Card Is Lost or Stolen?

Report it immediately to SASSA or Postbank. They will block the card and issue a replacement.

Is There a Fee for the SASSA Black Card?

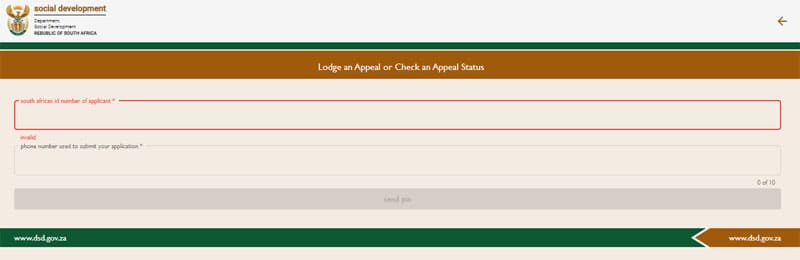

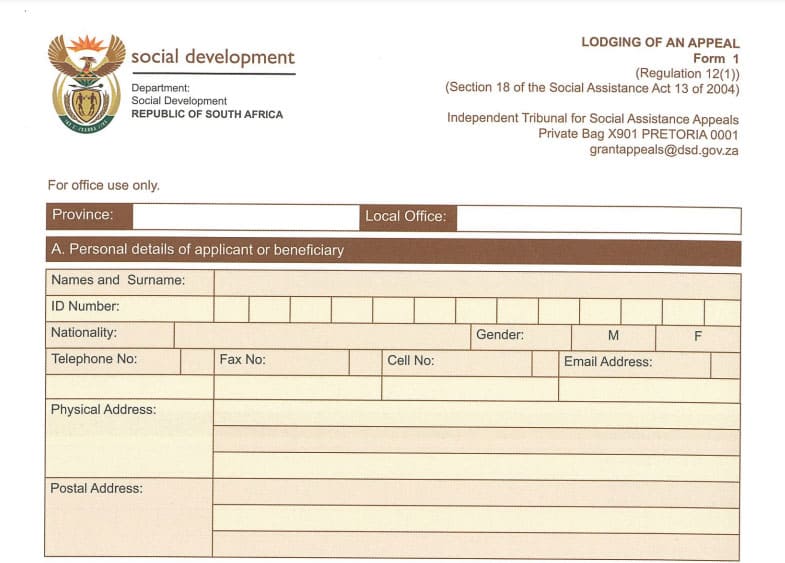

What to Do if Your Application is Rejected

If your SASSA black card application is rejected, you will be informed of the reasons for the rejection.

You have the right to appeal the decision. Contact SASSA for information on the appeals process.

How To Check My Postbank Card Balance?

You can check your Postbank Black Card balance through several methods:

- ATMs: Visit any Postbank ATM or a partner ATM to check your balance.

- USSD Banking: Dial a specific USSD code on your mobile phone (provided by Postbank) to access your balance information.

- Phone Banking: Call Postbank’s customer service line and follow the prompts to check your balance.

- Postbank App (If Available): If Postbank has a mobile app, you may be able to view your balance through the app.

Key Takeaways for SRD R350 Grant Recipients

If you’re using the SASSA Gold Card, you’ll need to transition to the SASSA Black Card to continue receiving your SRD R350 grant.

SASSA will notify you about the transition process, but it’s a good idea to proactively check your status or visit a SASSA office for confirmation.

If you prefer, you can switch to a bank account or Cash Send as your payment method instead of using the new card.

What To Do Next If You're a R350 SRD Grant Recipient

Check Your SASSA Status: Visit the SRD grant website or contact SASSA to confirm if you need to apply for the SASSA Black Card.

Update Your Payment Method: If you’d rather not use the card, update your payment details online.

Stay Informed: Keep an eye on official SASSA Gold Card news and announcements to avoid missing important updates.

By taking these steps, SRD R350 grant recipients can ensure they continue receiving their payments without interruption during the transition to the new SASSA Black Card.

Troubleshooting and FAQs

SASSA Gold Card Expiration?

The SASSA Gold Card is being replaced by the Postbank Black Card.

While there may have been expiry dates on older versions of the Gold Card, the transition to the Black Card means that the SASSA Gold Card expiry date could be any day soon.

Therefore, the focus should be on applying for and using the new Postbank Black Card.

It’s best to contact SASSA directly (0800 60 10 11) for any specific questions about the SASSA Gold Card expiration and phase-out and whether there is an official SASSA gold card expiry date as this information can change.

Keep an eye on official SASSA gold card news for the most up-to-date details.

Don’t delay your SASSA black card application!

Can I Still Use My SASSA Gold Card?

How to Activate My Postbank Black Card?

Your Postbank Black Card will likely need to be activated before you can use it. The activation process usually involves one of the following methods:

- USSD Activation: You may be able to activate your card by dialing a specific USSD code on your mobile phone and following the prompts.

- ATM Activation: Some cards can be activated at a Postbank ATM. Insert your card and follow the on-screen instructions.

- Phone Activation: Contact Postbank’s customer service line (0800 53 54 55) and follow their instructions to activate your card.

Postbank will provide specific instructions with your card. Look for a pamphlet or letter that comes with the card. If you’re unsure, contact their customer service line for assistance.

How to Reset PIN

If you’ve forgotten your Postbank Black Card PIN, you’ll need to reset it. The process usually involves one of these options:

- Visiting a Postbank Branch: The most common method is to visit your nearest Postbank branch with your ID document and your card. A consultant will assist you with resetting your PIN.

- Phone Banking (If Available): Some banks offer PIN reset through their phone banking system, but this may require prior registration. Contact Postbank to see if this is an option.

For security reasons, PIN resets are generally not done online. It’s crucial to protect your PIN and never share it with anyone.

What Should I Do If My SASSA Black Card Is Lost or Stolen?

Report it immediately to SASSA or Postbank. They will block the card and issue a replacement.

Is There a Fee for the SASSA Black Card?

What to Do if Your Application is Rejected

If your SASSA black card application is rejected, you will be informed of the reasons for the rejection.

You have the right to appeal the decision. Contact SASSA for information on the appeals process.

How To Check My Postbank Card Balance?

You can check your Postbank Black Card balance through several methods:

- ATMs: Visit any Postbank ATM or a partner ATM to check your balance.

- USSD Banking: Dial a specific USSD code on your mobile phone (provided by Postbank) to access your balance information.

- Phone Banking: Call Postbank’s customer service line and follow the prompts to check your balance.

- Postbank App (If Available): If Postbank has a mobile app, you may be able to view your balance through the app.

Key Takeaways for SRD R350 Grant Recipients

If you’re using the SASSA Gold Card, you’ll need to transition to the SASSA Black Card to continue receiving your SRD R350 grant.

SASSA will notify you about the transition process, but it’s a good idea to proactively check your status or visit a SASSA office for confirmation.

If you prefer, you can switch to a bank account or Cash Send as your payment method instead of using the new card.

Troubleshooting and FAQs

SASSA Gold Card Expiration?

The SASSA Gold Card is being replaced by the Postbank Black Card.

While there may have been expiry dates on older versions of the Gold Card, the transition to the Black Card means that the SASSA Gold Card expiry date could be any day soon.

Therefore, the focus should be on applying for and using the new Postbank Black Card.

It’s best to contact SASSA directly (0800 60 10 11) for any specific questions about the SASSA Gold Card expiration and phase-out and whether there is an official SASSA gold card expiry date as this information can change.

Keep an eye on official SASSA gold card news for the most up-to-date details.

Don’t delay your SASSA black card application!

PS. If your application has been declined you should submit a SASSA 350 Appeal here.

Can I Still Use My SASSA Gold Card?

How to Activate My Postbank Black Card?

Your Postbank Black Card will likely need to be activated before you can use it. The activation process usually involves one of the following methods:

- USSD Activation: You may be able to activate your card by dialing a specific USSD code on your mobile phone and following the prompts.

- ATM Activation: Some cards can be activated at a Postbank ATM. Insert your card and follow the on-screen instructions.

- Phone Activation: Contact Postbank’s customer service line (0800 53 54 55) and follow their instructions to activate your card.

Postbank will provide specific instructions with your card. Look for a pamphlet or letter that comes with the card. If you’re unsure, contact their customer service line for assistance.

How to Reset PIN

If you’ve forgotten your Postbank Black Card PIN, you’ll need to reset it. The process usually involves one of these options:

- Visiting a Postbank Branch: The most common method is to visit your nearest Postbank branch with your ID document and your card. A consultant will assist you with resetting your PIN.

- Phone Banking (If Available): Some banks offer PIN reset through their phone banking system, but this may require prior registration. Contact Postbank to see if this is an option.

For security reasons, PIN resets are generally not done online. It’s crucial to protect your PIN and never share it with anyone.

What Should I Do If My SASSA Black Card Is Lost or Stolen?

Report it immediately to SASSA or Postbank. They will block the card and issue a replacement.

Is There a Fee for the SASSA Black Card?

What to Do if Your Application is Rejected

If your SASSA black card application is rejected, you will be informed of the reasons for the rejection.

You have the right to appeal the decision. Contact SASSA for information on the appeals process.

How To Check My Postbank Card Balance?

You can check your Postbank Black Card balance through several methods:

- ATMs: Visit any Postbank ATM or a partner ATM to check your balance.

- USSD Banking: Dial a specific USSD code on your mobile phone (provided by Postbank) to access your balance information.

- Phone Banking: Call Postbank’s customer service line and follow the prompts to check your balance.

- Postbank App (If Available): If Postbank has a mobile app, you may be able to view your balance through the app.

Need Help with Your SASSA Black Card Application?

Contact Information For SASSA and Postbank Support

- SASSA Helpline: 0800 60 10 11

- SASSA Website: www.sassa.gov.za

- Email: [email protected]

Postbank Contact Information

For inquiries specifically about the Postbank Black Card, account-related matters, or technical issues, you can reach Postbank through these channels:

- Postbank Customer Care: 0800 53 54 55

- Email: [email protected]

- Website: www.postbank.co.za

Where to Find More Information

- Visit the official SASSA website: www.sassa.gov.za

- Check the latest SASSA Gold Card news for updates on the transition.

Final Thoughts On the SASSA Black Card and Gold Card Expiration

The transition from the SASSA Gold Card to the new Postbank Black Card is designed to make life easier for beneficiaries.

If you haven’t already, start your SASSA Black Card application today to avoid any disruptions in receiving your grants.

For more information, visit your nearest SASSA office or contact their helpline – contact details above.

By staying informed and taking action, you can ensure a smooth transition to the new SASSA Black Card and continue accessing your benefits without any hassle.

When Does the SASSA Basic Income Grant Start in South Africa? Your 2025 UBIG Guide!

Find Out If You Qualify, How to Apply, and When the Basic Income Grant Starts

Want to know when will the Basic Income Grant start and how it can help you?

South Africa’s move to implement the Universal Basic Income Grant (UBIG) throughout South Africa is expected to start in February 2025.

This guide cuts through the confusion, giving you the confirmed launch date, eligibility essentials, and how you can potentially benefit from this groundbreaking initiative.

If you’re aged 18-59, a South African citizen or permanent resident, with very little to no income

What is the SASSA Universal Basic Income Grant?

Defining the SASSA UBIG and its Purpose

- The SASSA Universal Basic Income Grant (UBIG), also known as the Basic Income Grant (BIG), is a proposed social security measure in South Africa designed to alleviate poverty and promote economic well-being.

- Purpose:

It aims to provide a guaranteed, unconditional, and dignified cash transfer to eligible South African residents aged 18-59, creating an income floor and safety net.The SRD Grant has given us an important opportunity to hold the government accountable for the progressive realisation of social security.

- South Africa as a Pioneer:

South Africa has the potential to be among the first countries to implement a UBI, providing regular payments to individuals, regardless of employment status8.

When the Basic Income Grant Starts, How Will It Be Different to Other SASSA Grants

“The SASSA Universal Basic Income Grant (UBIG) stands out from other social grants in South Africa because it’s designed to be universal.

What this means is that it aims to provide financial support to a broader population, regardless of specific circumstances like age or employment status.

Unlike grants such as the Child Support Grant or Older Persons Grant, which target specific groups, the UBIG offers a more inclusive safety net.

It’s not just about addressing immediate needs but also empowering individuals to break the cycle of poverty by providing consistent, unconditional support.

Think of it as a stepping stone toward financial stability for everyone, not just a select few.”

Key Features of the 2025 SASSA UBIG

SASSA Grant Eligibility 2025: Do You Qualify for the UBIG?

Wondering if you’re eligible for the new SASSA Universal Basic Income Grant (UBIG) in 2025?

This section breaks down the key criteria.

- Age:

South Africans between the ages of 18 to 59 may qualify.

Important Note: Existing grant beneficiaries who already get old-age or child grants will not be eligible. - Residency:

You must be a South African citizen or a permanent resident to qualify. - Income:

While the specific income thresholds are still being finalized, the UBIG is intended to help those with very low or no income.

Detailed information about eligibility will be released by South Africa’s social security agency SASSA. - Other Grants:

You cannot be a recipient of any other government-funded grants or pensions.

However, the exact eligibility details are still pending.

Application Process: How to Apply for the SASSA UBIG

Want to apply for the SASSA UBIG?

- While the official process is still being finalized, here’s what you can expect, drawing from previous SASSA grant applications.

- Online Application:

– Visit the official SASSA website.

– Locate the UBIG application section.

– Fill in your personal information accurately.

– Upload required documents.

– Submit the application and wait for confirmation via SMS or email. - Offline Application:

– Visit your nearest SASSA office.

– Obtain and complete the UBIG application form.

– Attach required documents (see below).

– Submit the application and receive a confirmation message. - Required Documentation:

– Valid South African ID12.

Proof of residence.

– Proof of income (if employed).

– Applicants will receive a confirmation SMS or email.

– Payments will be made monthly, starting February 2025.

UBIG Payment Amounts: How Much Will You Receive?

Naturally you want to know how much the SASSA basic income grant will pay you when it starts in South Africa.

So here’s what you need to know about payment amounts and frequency of the SASSA UBIG.

- Estimated Amounts:

The proposed UBIG payment amounts are said to be between R800 and R1,200 per month, which is a significant increase from the SRD R350 grant.

- Arguments for for R1500:

Many people are pushing for the grant to be set at R1500 a month to meet basic needs and ensure a minimum income, for all in South Africa aged between 18-59. - Frequency:

Payments are expected to be made monthly but probably not on the same dates as other SASSA payment dates.

SASSA UBIG 2025: Get Ready to Secure Your Grant When it Starts!

The SASSA Universal Basic Income Grant (UBIG) could be a game-changer for many South Africans in 2025.

It will be active throughout South Africa starting in February 2025.

If you’re aged 18-59 with little to no income, it could give you a vital financial boost to cover basics like food and housing.

The grant offers a guaranteed income to the most marginalised.

We encourage you to stay informed and keep an eye on updates from SASSA.

Take action, check if you qualify, and apply when applications open.

It’s a crucial first step towards ensuring social security and economic upliftment and stability.

7 Essential Steps for Effective Budgeting and Planning to Build Long-Term Wealth

What is Budgeting?

Before we start with budgeting and planning I should just clarify the definition of what is budgeting.

Imaging your take-home pay is R15,000 a month.

How will you be able to pay for all your essential expenses such as housing, food, insurance, medical, debt repayment, and still have some money left for fun from R15K?

With so many financial obligations to juggle, you can easily feel lost or stressed about your financial situation.

Your solution lies in effective budgeting and planning.

- Budgeting is the process of creating a plan to manage every rand or dollar that you earn.

- Starting with your earnings (after tax), a budget tracks your income and expenses, setting financial goals, and making informed decisions about what to spend your money on.

- By mastering budgeting and planning, you can take control of your finances and pave the way to long-term wealth and a stress-free life.

Here’s how to do it in seven essential steps.

Step 1. Track Your Current Income and Expenses (Know Where Your Money Goes)

Before you can create a budget, you need to understand where your money is currently going.

This is like creating a map before a road trip – you need to know your starting point.

Tracking your spending reveals your current financial habits and helps you identify areas where you can make changes.

There are several ways to track your expenses:

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), or Personal Capital can automatically track your transactions.

- Spreadsheets: If you prefer a hands-on approach, create a simple spreadsheet to log your income and expenses.

- Notebook or Journal: Even a simple notebook can work. Just write down every time you spend money.

Separate your expenses into two categories:

- Fixed Expenses: These are costs that stay roughly the same each month, like rent, mortgage payments, or loan repayments.

- Variable Expenses: These are costs that change from month to month, like groceries, entertainment, or gas.

Tip: You should track your spending for at least one to three months to get a truly accurate picture of your spending habits.

This will help you see where your money is really going and make informed budgeting and planning decisions.

PS. Start budgeting with this free online Budget Planner which you can save into Google Sheets for reference.

Step 2: Set Clear Financial Goals (Know Where You Want to Go)

Now that you know where you are financially, it’s time to decide where you want to go. Setting clear financial goals gives you direction and motivation. Think about what you want to achieve with your money, both in the short term and the long term.

Use the SMART method to set your goals:

- Specific: Clearly define what you want to achieve (e.g., “Pay off my $1,000 credit card debt”).

- Measurable: Set a quantifiable target (e.g., “Pay off $200 per month”).

- Achievable: Make sure your goal is realistic given your current income and expenses.

- Relevant: Ensure your goal aligns with your overall financial priorities.

- Time-bound: Set a deadline for achieving your goal (e.g., “Pay off the debt within 5 months”).

Examples of financial goals:

- Short-term: Build a $1,000 emergency fund, pay off a small credit card.

- Mid-term: Save for a down payment on a car or a small home, start a side hustle.

- Long-term: Save for retirement, pay for your children’s education, achieve financial independence.

Prioritize your goals based on what’s most important to you and the timeframe for achieving them. This is a crucial step in budgeting and planning for your future.

Step 3: Create a Realistic Budget (Your Financial Roadmap)

A budget is simply a plan for how you’ll spend your money.

It helps you allocate your funds effectively and work towards your financial goals. There are several budgeting methods you can use:

- 50/30/20 Rule: Allocate 50% of your income to needs (essentials like rent, groceries, child care, and utilities), 30% to wants (non-essential spending like dining out or entertainment), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Allocate every dollar of your income to a specific expense category, so your income minus your expenses equals zero.

- Envelope System: Use cash and divide it into envelopes for different spending categories. Once an envelope is empty, you can’t spend any more in that category.

Choose the method that best suits your personality and spending habits.

The most important thing is to create a budget that you can actually stick to.

Remember, budgeting and planning are ongoing processes, so be prepared to adjust your budget as needed.

Step 4: Build an Emergency Fund (Your Financial Safety Net)

As I’m sure you know or have experienced this often enough but life has a nasty habit of throwing you curveballs when you least expect it.

Unexpected expenses like car repairs, medical bills, or even losing your job can derail your finances if you’re not prepared.

That’s where an emergency fund comes in.

- An emergency fund is money set aside specifically for unexpected events.

- Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account.

- This will give you a financial cushion to fall back on during difficult times.

This is a key part of effective budgeting and planning.

Step 5: Pay Down High-Interest Debt (Free Yourself From Debt)

High-interest debt, like credit card debt, can significantly hinder your progress toward financial wealth. The interest charges can eat away at your money and make it difficult to save or invest.

Two popular debt payoff strategies are:

- Debt Snowball Method: Focus on paying off your smallest debt first, regardless of the interest rate. This provides quick wins and motivates you to keep going.

- Debt Avalanche Method: Focus on paying off the debt with the highest interest rate first. This saves you the most money in the long run.

Prioritize paying down high-interest debt before aggressively investing. This is a very important part of budgeting and planning to get out of debt.

Step 6: Start Investing for the Future (Grow Your Wealth)

Once you have an emergency fund and are managing your debt, you can start thinking about investing.

Investing is crucial for building long-term wealth. It allows your money to grow over time and helps you achieve your long-term financial goals.

There are many different investment options available, including:

- Stocks: Represent ownership in a company.

- Bonds: Represent a loan you make to a company or government.

These type of bonds are not to be confused with mortgage bonds. - Real Estate: Investing in property.

- Mutual Funds/ETFs: Collections of stocks, bonds, or other assets.

It’s important to understand your risk tolerance and diversify your investments. If you’re unsure where to start, consider seeking advice from a qualified financial advisor. This is a crucial part of budgeting and planning for your future.

Step 7: Regularly Review and Adjust Your Plan (Stay on Track)

Budgeting and planning aren’t one-time events; they’re ongoing processes.

Your financial situation and goals may change over time, so it’s important to regularly review and adjust your plan.

Schedule regular check-ins with yourself (monthly, quarterly, or annually) to review your budget, track your progress toward your goals, and make any necessary adjustments.

This is how you stay on track with your budgeting and planning.

Conclusion

Budgeting and planning are essential tools for building long-term wealth, even if you’re currently in debt.

By following these 7 steps, you can take control of your finances, make smart financial decisions, and work towards a brighter financial future.

Start today, even with small steps, and you’ll be on your way to achieving your financial dreams.

PS. It goes without saying that knowing how to save money will help you grow your wealth together with proper budgeting.

April 2025 SASSA Payment Schedule: Your Confirmed Payment Dates

When to Collect Your SASSA Payments: What You Need to Know for April 2025

SASSA payment dates for April 2025 have been released, and knowing them is important for you to plan your monthly expenses.

Whether you’re relying on the Old Age Pension, Disability Grant, Child Support Grant, or any other SASSA social grant, you need these April 2025 SASSA payment dates to plan ahead.

Below, you’ll see the confirmed SASSA grant payment schedule for April, showing each type of social grant to make it easy for you to plan your money and to get your grant payment when you expect it.

PS. Attention all SASSA Beneficiaries!

Your Gold Card will be phased out and replaced by the new Black Card in due course.

Click here for everything you need to know about the new SASSA Black Card Application »

SASSA Old Persons, Child Support & Disability Grant Payment Dates

| Month | Group | Date |

|---|---|---|

| April 2025 | Old Age Grant Payment Date | Thursday 3rd April |

| April 2025 | Disability Grants | Friday 4th April |

| April 2025 | Child Support Grants | Saturday 5th April |

| April 2025 | Other SASSA Social Grants | From 6th to 30th April |

| April 2025 | SASSA R350 Grants | SRD Grant Payments will be processed from the 24th to 30th April 2025 – Find Out Where To Get Your SASSA R350 Grant Payments here |

For SRD beneficiaries, go here to do your SASSA status check for 350 payment dates

SASSA Payment Dates for 2025 for Foster Child, Care Dependency, and War Veteran’s Grants

SASSA payments dates for the following grants:

- Foster Child Grant

Tuesday 5th April 2025. - Care Dependency Grant

From 5th April 2025 - War Veteran’s Grant

From 5th April 2025

All of the above grants will be paid on 7th April 2025

Please note that grant payments can take up to three days to reflect in your bank account, especially for different banks, and if the payment was made just before a weekend.

PS. Click the following link if you’re wondering when will the basic income grant will start in South Africa »

Beneficiaries registered to receive the R350 SRD grant can see where to collect their payment here once they have been notified by SMS.

If you aren’t sure whether you are registered to receive your grant payment, you should do your SASSA Payment Status Check now for an immediate response.

How Much is SASSA Payment

-

- SASSA Old Persons Grant: R2,090

-

- Old Age Grant (75 years and older): R2,110

-

- Disability Grant: R2,090

-

- War Veterans Grant: R2,090

-

- Child Support Grant: R510 per child

-

- Child Support Grant (Top-up): R510 + R250

-

- Care Dependency Grant: R2,090

-

- Foster Care Grant: R1,180 per child

-

- Grant-In-Aid: R510

-

- Social Relief of Distress Grant: R370

PS. See the SASSA Grant Increase 2025 which comes into effect on 1st April 2025

Collecting SASSA Payments

When it comes to collecting your money on the correct SASSA payments dates, please remember that you do not have to collect your grant payment on the actual grant date as published above.

SASSA assures grant recipients that there is no requirement to withdraw their grant payment as soon as the funds are made available as the money will remain in the beneficiary’s account.

Whilst it’s understandable that many beneficiaries are under extreme pressure to get their money and cannot wait another day, for those who can wait it’s better not to rush to collect your grant payments immediately.

So if you can wait a day or so, below are two reasons not to rush to get your SASSA payments.

2 Reasons Not to Collect Your Grants on the Published SASSA Payments Dates

-

- Avoid long queues:

Even though your payment is ready to collect you can avoid long queues at the SASSA payment points.

This will save you wasting time, sometimes a whole day, to get your payment. - Your grant money won’t disappear:

Your money will remain in your account until you withdraw it.

So you do not have to worry about it disappearing from your account if you don’t go to collect it on the day it becomes available. - You can also collect your money from the Safe Collection Points as explained below.

- Avoid long queues:

These reasons will hopefully give you peace of mind and make the collecting of your grant much less stressful than going on the exact grant payment dates.

For more information on SASSA Grant Payments and to get access to all SASSA forms click here.

PS. If you haven’t been paid, or your application has been denied, you can appeal this decision with SASSA.

Go here to find out how to submit your SASSA Appeal

Guide to Safe SASSA Grant Collection Points

Safe places where SASSA beneficiaries can collect their grants every month:

- Retail Outlets:

Beneficiaries can collect their grants at several retailers across the country.

These include:

– Pick n Pay

– Shoprite

– Boxer

– U-Save

– Checkers

– Selected OK Food stores

– Usave stores - Bank ATMs and Post Bank (at the Post Office):

Beneficiaries can also collect their grants from bank ATMs and the Post Bank at the Post Office. - Mobile Cash Pay Points:

You can go to any of the mobile cash pay points that have been made available for grant beneficiaries to collect their money. - SASSA Pay Points:

You can also collect from SASSA pay points which can be found in rural areas where access to other collection points is difficult.

And these pay points are safe for beneficiaries to go to and are often guarded during grant distribution days to endure your safety – when you carry cash there’s always a risk of being robbed. - Bank Payments (EFT):

If you have a bank account this is one of the most efficient ways of getting your grant payments as the money will be paid directly into your account which you can access anytime you need. - Spaza Shops:

SASSA is working with spaza shops to use as payment points so that your grant payments can be collected easily and more accessible at the local level.

As mentioned above, remember that you do not need to collect your grant on the day it becomes available as the money will remain on your card until you decide to use it – it won’t disappear.

Another useful tip is to use your SASSA cards for purchases as it reduces the cost for both Postbank and SASSA, and reduces the risk of you being robbed as you won’t be carrying around cash.

SASSA Contact Information for R350 Grants

If you have any queries regarding your SASSA Grant Payments Dates, you can use any of SASSA’s contact details below to get clarity

SASSA contact number for R350: 0800 601 011

WhatsApp Number: 082 046 8553

SASSA appeal helpline: 0800 60 10 11

SASSA email address: [email protected]

Independent Tribunal for Social Assistance Appeals (ITSAA): 012 312 7727 or 086 216 371

SASSA USSD Number: *134*7737#

PS. Has your application been declined?

Then go to this link to see exactly how to successfully submit your SASSA Appeal for R350 and get approved.

Under Debt Review and Need a Loan Urgently? Quick Solutions

Legitimate NCR-registered lenders generally don't offer loans to those under debt review.

We explain why and discuss the risks of alternative, unregulated options.

Get all the solutions here

Loans For Debt Review Clients Cape Town, Johannesburg South Africa

When you’re under debt review and need a loan urgently in Cape Town or Gauteng, Johannesburg, or anywhere else in South Africa, securing emergency funding becomes challenging.

Even if you look for instant loans or same-day loans under debt review, you should know that loans for debt review clients will only be available through lenders that aren’t registered with the National Credit Regulator (NCR) – which carries significant risks.

So, even if you just need a R5000 loan, a small R2000 loan, or even a micro loan while under debt review, the reality is that getting any additional credit through legitimate channels is not just difficult, it’s actually prohibited by the National Credit Act (NCA) in South Africa.

And this applies to all types of credit – from weekend loans to WhatsApp loans under debt review, and even loans with guarantors.

Therefore, no NCR-registered institution can legally provide loans during debt counselling, regardless of your employment status or income source.

However, there is hope: once you complete the debt review process and receive your clearance certificate, you’ll be able to apply for any credit again.

This includes personal loans, emergency funding, and other financial products through registered lenders.

PS. It’s important to note that even if you’re desperately searching for where to get a R5000 loan while under debt review, or considering payday loans during debt review, these options remain prohibited by law.

This applies whether you’re a government employee, self-employed, or working on commission.

Reasons Why Loans for Debt Review Clients Are Not Allowed

Here are some of the reasons why loans for people under debt review are prohibited from being granted;

- The National Credit Act prohibits financial institutions from offering loans to individuals under debt review.

- Although you may not realise it when you urgently need a loan, this regulation protects you and the lenders by ensuring responsible lending practices so you don’t get deeper into debt.

- When you’re under debt review, you’re actively managing and consolidating existing debts.

- Imagine getting additional loans while under debt review, your financial situation would worsen and most likely lead to deeper debt making your life miserable.

- Even consolidation loans for debt review clients are off the table and do not play any part in the debt review process.

5 Easy Ways for Debt Review Clients to Get Money

While loans for debt review clients are off the table there other solutions that you can generate some extra money from to alleviate your financial hardship during the debt review process.

- Apply for a SASSA Grant:

As one of the many debt review clients in South Africa, you are allowed to apply and get social grant payments as long as you meet the eligibility criteria set by the South African Social Security Agency (SASSA).

You can also apply for the R350 SRD Grant. - Sell Unused Items:

Declutter your belongings and consider selling unwanted items online through platforms like Gumtree, Facebook Marketplace, or local classifieds.

This can be a quick way to generate some extra cash while decluttering your space. - Freelance or Piece Work:

Explore freelance, side hustles, or piece job opportunities that offer flexible schedules and remote work possibilities.

Platforms like Upwork, Fiverr, or Freelancer.com offer a variety of remote projects that can be done in your spare time. - Develop and Sell Crafts or Skills:

If you have a creative skill or talent, consider selling handmade crafts, artwork, or offering personalized services on online marketplaces like Etsy or through social media platforms. - Become an Online Tutor:

If you have expertise or good knowledge in a specific subject, offer online tutoring services to students.

Platforms like TutorMe or Chegg connect tutors with students seeking academic support.

Remember, to always be transparent with your debt counsellor:

Regardless of your chosen income-generating activity, always be open and transparent with your debt counsellor.

They can ensure that your choice to earn extra money complies with the debt review regulations and doesn’t jeopardise your progress.

So despite loans for people under debt review being prohibited, you do have some really good options to earn some extra money to make ends meet.

Coping with Financial Challenges During Debt Review

Managing your finances under debt review can be challenging, but here are some coping strategies.

- Create a realistic budget:

Track your income and expenses to identify areas where you can cut back. - Prioritize essential needs:

Focus on essential expenses like housing, food, and utilities while managing other expenses creatively. - Communicate openly:

Be transparent with family and friends about your financial situation and don’t spend money trying to impress people. - Seek emotional support:

Struggling for money to get by every month is emotionally draining and depressing.

Therefore, talking to trusted individuals or seeking professional counselling can help manage stress and anxiety. - Payday loans for debt review clients:

Do not be tempted to look at payday loans as they are also prohibited for debt review clients.

Furthermore, do not fall into the trap of looking for debt relief in the form of getting credit from loan sharks.

They’ll make your life a misery and make debt review seem like a walk in the park compared to the hell they’ll put you through.

Please seek emotional support (above) or reach out to one of the organisations below for assistance.

Understanding Your Options During Debt Review

While being unable to apply for loans while under review may seem unfair during financial hardship, remember that debt review is a temporary measure to help you regain financial control.

Here are some alternative solutions to consider:

- Contact Your Debt Counsellor Immediately:

Debt review clients have a personal debt counsellor whom than can reach out to for guidance and counselling.

See below, what your debt counsellor can do for you.

They’re also there to discuss available options and help you understand the implications of seeking additional credit while under debt review. - Negotiate existing loan repayments:

Contact your creditors and discuss extending repayment terms or lowering interest rates within the debt review plan.

You can probably do this with the help of your debt counsellor. - Seek financial counseling:

Professional guidance can help you manage your budget, prioritize debts, and explore alternative avenues for financial stability. - Explore government support programs:

Depending on your circumstances, you might be eligible for government support programs offering financial assistance and resources.

How Long Does Debt Review Last

How long debt review takes in South Africa depends on various factors, but it usually takes 3 to 5 years for most people under debt review to complete the program.

While there’s no exact time frame to determine how long debt review lasts, here’s a breakdown of the factors that can affect how long it takes:

1. Total Debt Amount:

The larger your total debt, the longer it will take to repay it through the consolidated monthly payments in the debt review plan.

2. Affordable Repayment Amount:

The amount you can realistically pay towards your debt each month significantly impacts the time it will take to become debt-free.

Higher affordable repayments lead to a shorter completion period.

3. Negotiating Terms:

The negotiation process with creditors impacts your repayment terms, such as interest rates and repayment period.

Favorable negotiation results can potentially shorten the overall debt review duration.

4. Adherence to the Plan:

Consistent adherence to the agreed-upon monthly payments is crucial.

Missing payments can lengthen the program due to potential penalties or adjustments to the repayment plan.

5. Unforeseen Circumstances:

Unexpected events like job loss or medical emergencies might require adjustments to the repayment plan, potentially impacting the overall duration.

Therefore, the 3 to 5 year timeframe for how long you stay under debt review is just a general guideline.

However, you must remember that how long your debt review lasts can be shorter or longer depending on your specific circumstances and commitment to the program.

Here are some additional points to consider:

- Consulting your Debt Counselor:

They can provide a more personalized estimate of your debt review duration based on your current financial situation and the negotiated terms with your creditors. - Focus on Completion:

Completing the debt review program successfully can significantly reduce how long you stay under debt review and improve your financial stability and credit score in the long run.

Being Under Debt Review Will Come to an End

Remember, debt review is a process, not a permanent state.

And it’s there to help you get out of debt and live a normal life where you can get credit to buy things like appliances, a car, or even a house.

Therefore, by using available resources, staying committed to your plan, and practicing responsible financial management, you can successfully navigate this period and achieve financial stability in the long run.

You will get through this successfully as long as you do not lapse into getting loans from dubious lenders who can make your life a misery.

PS. This Reddit poster had R23k per month debt and only about R3k per month income – this is the advice they got about handling their debt, the alternatives to going under review and the truth about debt review.

How to Get Debt Review Clearance Certificate

Getting your debt review clearance certificate in South Africa involves completing the following steps:

1. Fulfill Your Debt Review Obligations:

- This is the essential step, requiring you to make all your monthly debt review payments in full and on time throughout the agreed-upon program duration.

- Ensure all fees associated with the debt review process are settled.

2. Communication with Debt Counselor:

- Once you’ve completed all your obligations, communicate with your registered debt counselor to initiate the clearance certificate process.

- They will verify your completion and gather the necessary documentation.

3. Processing by Debt Counselor:

- Your debt counselor will prepare and submit the clearance certificate to all relevant credit bureaus in South Africa.

4. Credit Bureau Updates:

- The credit bureaus will update your credit report to reflect your completion of the debt review and remove the “debt review” flag.

This process can take several weeks depending on the individual bureau’s procedures.

Additional Considerations:

- How long does it take to get a clearance certificate:

While there’s no guaranteed timeframe, receiving your clearance certificate can take several weeks to a few months due to processing by both the debt counselor and credit bureaus. - Patience:

Be patient and allow time for the administrative process to complete. - Communication:

Maintain contact with your debt counselor for updates and any required actions. - Independent Verification:

After a reasonable wait, consider contacting credit bureaus directly to verify the update of your credit report.

Remember, getting your clearance certificate signifies the completion of your debt review program and it’s an important step towards rebuilding your financial well-being.

Debt Review Success Stories

If you’re feeling overwhelmed by being under debt review, these success stories of normal South Africans who have successfully completed the review process will give you hope.

Success Story 1: Thandi Shares her Story to Break the Shame of Being Trapped in Debt

Thandi, a single mother of two young children in Soweto, found herself drowning in debt after a series of unfortunate events.

With limited income and mounting expenses, she felt hopeless.

After struggling for months on her own, Thandi’s sister suggested debt review – a process Thandi had heard negative things about.

Desperate, she reluctantly contacted a registered debt counselor.

The process wasn’t easy.

Thandi faced additional challenges due to her community’s reliance on informal lending practices.

Budgeting every cent and learning to live within her means required major adjustments.

However, with her counselor’s support and her family’s encouragement, Thandi persevered through feelings of shame and the stigma that followed.

Three years later, Thandi received her clearance certificate.

You can just imagine the relief she felt after that huge weight was lifted from her shoulders.

Not only was she debt-free, but she had empowered herself with financial knowledge.

Today, Thandi shares her story to break the shame of constantly being in debt and struggling to make ends meet and offers guidance to others in her community.

Success Story 2: Sipho, a Young Entrepreneur from Alexandra Township

Sipho saw his dreams of making it big in business fading away as he got deeper and deeper into debt.

After a bad investment, the community that believed in him started to doubt whether he was clever enough to run a successful business.

Sipho began to feel the pressure to succeed, not only for himself but also for those who had placed their faith in him.

Besides, his business desperately needed money to survive and going under was just not an option for Sipho.

Can you imagine the shame and humiliation he would’ve felt, not to mention not having money to live on either?

But despite the shame and fear of failure, Sipho confided in a mentor, who encouraged him to seek professional help.

With guidance from a debt counselor, Sipho enrolled in the debt review program.

Negotiating with creditors was challenging, but Sipho used the little business acumen he had to explore additional income streams.

And then, after four years, Sipho walked out of the debt counsellor’s office with his debt review clearance certificate.

Now, with financial responsibility woven into his business model, Sipho is a role model in his community.

He advocates for financial literacy and helps fellow entrepreneurs build resilient businesses rooted in sound financial practices.

Success Story 3: The Overwhelmed Family

The Mazibuko family, living in a township near Cape Town, found themselves overwhelmed by rising costs and debt from unforeseen expenses.

Both parents worked tirelessly, but their income couldn’t keep up with payments and the stress of drowning in debt that mounted each month.

Concerned about their children’s futures, they visited a financial advisor in their community who referred them to a debt counselor.

While apprehensive at first, the debt counsellor helped them understand the potential benefits of debt review in breaking the downward spiral of debt and financial hardship.

The review process required huge sacrifices, but with patience and unwavering support from one another, they learned to budget, reduce unnecessary spending, and prioritize financial well-being.

After five years, the Mazibukos received their clearance certificate.

They faced challenges rooted in systemic issues and struggled with the stigma of financial difficulty, but their commitment and perseverance paid off.

Today, they are financially independent, debt-free, and confident in creating a secure future for their children.

What Your Debt Counsellor Can do for You During Debt Review

You might think that your debt counsellor has the power to arrange consolidation loans for debt review clients, but they’re legally prohibited from arranging any additional credit for their clients.

This conforms with the National Credit Act, which protects lenders and debt review clients by ensuring responsible lending practices.

However, this is what your debt counsellor can do for you;

Instead of consolidation loans, registered debt counselors in South Africa are equipped to offer the following services:

- Debt assessment:

They analyze your financial situation and assess your eligibility for debt review. - Negotiation with creditors:

They have the authority to work for you to secure lower interest rates and extended repayment terms with your creditors.

This consolidates all your existing debts into a single, more manageable monthly payment without taking out a consolidation loan. - Budgeting and financial literacy:

They provide guidance on budgeting, managing finances responsibly, and avoiding future financial difficulties. - Support and guidance:

They offer ongoing support and advice throughout the debt review journey, helping you navigate challenges and achieve financial well-being.

Alternatives to Consolidation Loans for Debt Review Clients

As you can see above, a good debt counsellor can play an important role in making your debt review easier and less of a struggle.

Just imagine negotiating with all your creditors, yourself, to give you a longer time to pay your debt at lower interest rates too.

You wouldn’t be able to do it without a professional counsellor working for you and in your best interests.

More Alternative Solutions for Managing Debt:

While traditional consolidation loans are not available during debt review, other options can help you manage your debt more effectively:

- Get permission from your Debt Counselor to access funds:

Discuss alternative solutions with your counselor.

They might offer guidance on accessing funds within your existing debt review plan (like emergency funds) for unforeseen expenses. - Explore government support programs:

Depending on your circumstances, you may be eligible for government assistance programs offering financial aid (e.g., SRD R350 Grant). - Seek additional income ethically:

Explore authorized freelance work, selling unused items, or developing skills to generate extra income within your available time.

For more help and support, consult a qualified financial advisor for personalised guidance or reach out to anyone on the contact list below.

Contact List of People and Institutions that offer Debt Review Clients Help or Support

Government & Regulatory Bodies

- National Credit Regulator (NCR):

They regulate the debt review industry and provide resources for consumers. You can reach them through their website: https://nationalgovernment.co.za/units/view/126/national-credit-regulator-ncr or call their toll-free number: 0860 44 62 72. - National Consumer Commission (NCC):

They advocate for consumer rights and offer assistance with complaints against credit providers.

You can reach them through their website: https://thencc.org.za/ or call their toll-free number: 0860 134 326. - Department of Social Development (DSD):

They offer financial assistance programs and support for vulnerable individuals and families.

You can find their website here: https://srd.sassa.gov.za/ or contact your local DSD office. - Social Grants:

If you think you may qualify to get a social grant you can go here to check all the SASSA Grant FAQs

Non-Profit Organizations

- The Debt Counselling Alliance of South Africa (DCASA):

They offer information and support on debt review and financial management.

You can find their website here: https://www.ndca.org.za/ - The National Debt Reviewers Association of South Africa (NDRA):

They represent debt counseling companies and provide information on debt review.

You can find their website here: https://www.facebook.com/NCRDC3106/ or contact them via email: [email address removed].

Financial Advisors:

- Registered Debt Counselors:

These individuals can provide personalized advice and guidance throughout your debt review journey.

Find a registered Debt Counselor through the NCR website or contact your debt review provider for recommendations. - Independent Financial Advisors:

While they cannot offer specific advice on debt review, they can provide general financial guidance and assistance with budgeting, saving, and future financial planning.

Additional Resources for people Under Debt Review:

- Debt Review Information Portal:

https://www.ncr.org.za/register_of_registrants/registered_dc.php – A comprehensive resource center provided by the NCR with information on debt review, rights and responsibilities, and frequently asked questions.

When You're Under Debt Review and Need a Loan Urgently, Don't Do This...

Even if you’re under debt review and need a loan urgently do not be tempted to borrow money from a loan shark.

It could be the worst thing you do, for the following 3 reasons;

- Loan sharks will have little regard or sympathy for your desperate financial situation, except to capitalise on it.

- Whilst it may be fairly easy to get credit from a loan shark, it will come with unrealistic repayment terms combined with an unreasonably high-interest rate.

- Failing to make a repayment will probably result in all types of verbal, as well as physical, threats in the event of you missing a payment date.

These guys don’t play, so no matter how desperate you are do not be tempted.

Times are probably tough, but remember you’re only in this situation because of managing your money badly, so do not be tempted to take on additional debt especially from loan sharks.

However, if you’re fed up with the process & think you can manage without being under review, this is how you can get out of debt review.

Last Word on Loans for People Under Debt Review

- In the unlikely event, you find a lender willing to provide loans for people under debt review, look carefully at the interest rate being charged before signing & committing to any loan not being granted by a traditional lender or bank – it will almost certainly place you in a far worse financial situation.

- You should also ensure that the lender is registered with the NCR (National Credit Regulator) which would provide some protection & peace of mind as opposed to some of the unscrupulous lenders out there.

- Furthermore, it’s mostly loan sharks that may consider giving loans to debt review clients in South Africa which may give you some short-term debt relief.